Due to fierce competition in the downstream oil sector’s refined product prices, some oil marketers are starting to replace the Nigerian National Petroleum Company Limited’s branding on their filling stations as dealers abandon their franchise agreements with NNPCL.

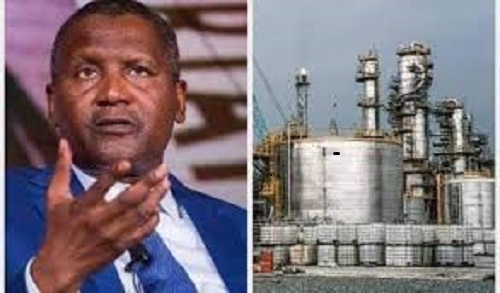

Many others, especially those in Lagos, are reportedly considering shifting in light of the recent collapse in refined product prices caused by the $20 billion Dangote Petroleum Refinery in Lekki.

Already some dealers that used to carry the NNPCL emblem on their filling stations located around Wawa on the Lagos-Ibadan expressway, as well as at Ibafo, still along the busy road, have dropped the name of the national oil business.

Particularly in Lagos and the neighboring states, a large number of filling stations that were once owned by the national oil company are currently being renamed and rebranded under the management of private oil marketers.

Additionally, it was discovered that additional marketers would give up their NNPCL licenses as a result of the Dangote refinery’s decreased loading prices for Premium Motor Spirit (petrol), which are currently less expensive than the landing costs of imported gasoline.

The Dangote Petroleum Refinery recently reduced its loading fees from N950 per liter to N890, reigniting a petrol pricing war in the industry.

Dealers clarified that the renaming of filling stations is a marketing strategy used to acquire cheaper goods at a lower cost from the Dangote refinery and other import suppliers.

In an exclusive interview on Tuesday, Chinedu Ukadike, the National Publicity Secretary of the Independent Petroleum Marketers Association of Nigeria, affirmed this claim.

In the oil industry, a franchise license is a legal authorization given to a person or business to run a business or distribute goods under a well-known brand or system.

This usually entails a contract that, in return for fees or a portion of sales, permits the franchisee to use the franchisor’s resources, operational model, and brand.

Ukadike clarified that since the NNPCL is no longer the sole importer and distributor of refined petroleum products, marketers have embraced this new strategy.

“Yes, that observation is correct,” he said. Some marketers are rebranding and transforming. Recall that NNPCL used to be the exclusive importer and distributor of gasoline. To obtain merchandise, marketers subsequently granted franchises to their filling stations.

Therefore, for NNPCL to have petroleum products, marketers typically give their businesses to the company. However, some marketers are switching to MRS filling stations now that the game has shifted. Since MRS is currently offering its products at a lower price than any other station. People are looking for a place where they can earn a return on investment and turnover.

What good does it serve to use the name Total as a brand if you don’t sell gasoline goods under that name? You must get rid of it and replace it with something better. The majority of those gas stations that are altering their names are not owned by NNPC. They were solely gathered by NNPC on the franchise.

Femi Soneye, the NNPCL spokeswoman, would not return calls to his phone, thus attempts to reach him for an explanation of why marketers are abandoning the company’s brand were futile.

Olatide Jeremiah, an oil and gas specialist who verified the agreement, claimed that marketers utilized the franchise license as a way to obtain less expensive goods from NNPCL, which at the time was still importing.

He acknowledged that the establishment of the Dangote refinery and the national oil company’s failure to reach a deal to fix petrol pricing with the Lekki-based facility had blocked the path that brought in additional money.

“Yes, it is true,” said Jeremiah, the CEO of petroleumprice.ng. All of this took place before the Dangote refinery’s establishment but after the subsidy was eliminated.

“After the removal and the price of gasoline increased, NNPCL was asked to control the price and should not be permitted to continue skyrocketing,” he continued.

Therefore, NNPCL and the majors set the price at N500, but the landing cost was higher. This had an impact on petroleum importers and independent marketers. For example, NNPCL and the majors were selling at N500 per liter, but Petrocam imported and claimed that its landing cost was N700. That was a significant loss and represents a N200 discrepancy.

In actuality, NNPCL was providing internal subsidies, and independent marketers started requesting NNPCL franchise licenses after realizing they were losing revenue. Because they were loading from the NNPCL depot at a lower rate, the marketers spent millions to obtain the franchise license.

Due to public outrage, NNPCL was in charge of setting prices for all the majors at the time, and they continued to purchase until Dangote entered the market. They attempted to fix the price with Dangote as well, but the deal fell through because Dangote wanted to sell to everyone. It was more affordable and available for direct purchase by independent marketers.

Since some marketers obtained licenses for one of their stations but transported goods to other stations and sold them to Nigerians at a higher price, the franchise license was also a way to increase profits. At the time, fuel tankers were scheduled to arrive twice a month.

According to Akinola Ogunyolemi, the Chairman of PETROAN in Lagos State, the majority of the shops were not initially owned by the NNPC.

According to him, the removal of the NNPCL symbol could indicate that either party has broken the terms of the agreement or that it has ended.

These are personal outlets. They will remove the NNPCL logo if an NNPCL contract expires and they are not prepared to proceed with it or if they receive a compelling offer. They will use other people’s names and rebrand once more. That might be the cause.

The majority of the stores are not owned by NNPCL. With your contract with them, you can have your filling station constructed and place NNPCL there. You may choose to go ahead and turn over the station to Mobil or Total if they are unable to fulfill your agreement with them (because they occasionally violate contracts as well). “You own it,” Ogunyolemi declared.

Additionally, experts pointed out that since imported gasoline is currently more expensive than goods from the Dangote refinery, more permits might be withdrawn.

The Major Energies Marketers Association recently released data showing that the on-spot cost of landing PMS at the ASPM was N910.14 per liter, while at the NPSC depot, it was N910.52.

The 30-day average price of petrol increased to N939.03 a liter, according to the document.

In the meantime, new information surfaced about the behind-the-scenes activities that helped lower the ex-gantry loading cost of Premium Motor Spirit, also referred to as gasoline, which comes from the Dangote Petroleum Refinery and may result in lower retail prices for Nigerians.

The refinery said in a statement signed by Anthony Chiejina, Group Chief Branding, and Communications Officer, that the strategic change is a direct reaction to the recent decline in global crude oil prices as well as the optimistic prognosis in the global energy and gas markets.\

“With effect from Saturday, February 1st, 2025, Dangote Petroleum Refinery has lowered the ex-depot (gantry) price of Premium Motor Spirit, also referred to as gasoline, from N950 to N890. This strategic change is a direct reaction to the optimistic outlook in the global energy and gas markets, as well as the recent decline in international crude oil prices,” the statement said.

As stated in the refinery’s announcement on January 19, when a slight rise was enacted as a result of the previously rising international crude oil prices, it was pointed out that the price revision reflects the continuous volatility in the world’s crude oil markets.

Tuesday’s price of Brent crude, the global standard, was $76.76 per barrel, down $4 from early January’s price of $81 per barrel.

Although this claim is entirely true, downstream merchants told our correspondent that the decision to lower its gasoline prices was influenced by a pricing war between Dangote, the NNPCL, and other marketers.

About a week ago, the NNPCL and a few significant marketers found a different source to import refined products at a lower landing cost than Dangote’s price, which sparked the start of this new pricing war.

Despite domestic production of Premium Motor Spirit (petrol) and Automotive Gas Oil (diesel), the national oil corporation and other downstream oil marketers imported over 633 million liters of these commodities in January 2025, according to a study released last Friday.

“Private depot and Dangote prices were at the same level for a few weeks, unlike before when there was a N20 difference,” a merchant stated. We discovered that some people are going after Dangote because they are sourcing cheaper goods from outside the nation. These depots had to do it to remain competitive because they didn’t want to go out of business.

According to a second source who verified the information, Dangote senior executives called a meeting in response to the worries of bulk buyers who were losing N31.02 per liter, or N310,159,109.59 in total.

However, the source pointed out that the refinery is still making a consistent profit despite the output cut, proving its flexibility and financial viability.

He claimed that due to significant grievances and worries from their customers, Dangote’s price cut was unavoidable. Senior executives from Dangote met to address this on Friday between 4 and 5 p.m. Nigerians may anticipate increased pricing wars amongst companies in the downstream sector, which is essentially the result of deregulation.

READ MORE HERE: 13 Ways to Make Money Online Fast

FEEL FREE TO SHARE THIS ARTICLE USING THE SOCIAL MEDIA HANDLES BELOW